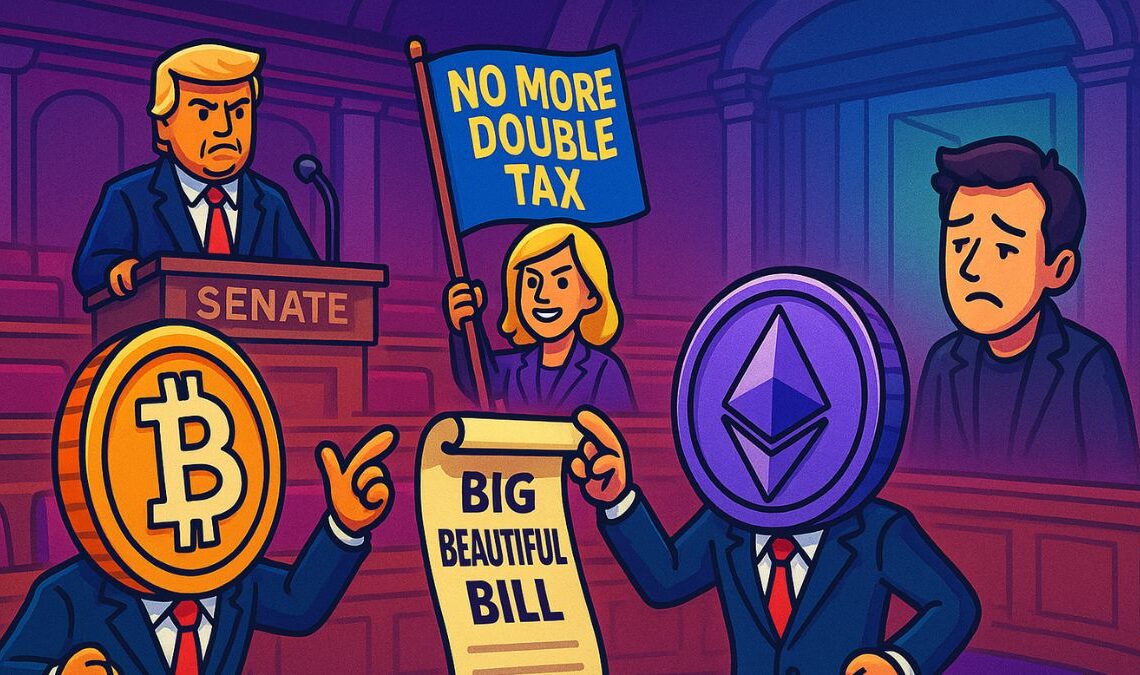

A new political storm is brewing in Washington as crypto amendments derail the progress of Donald Trump’s “Big Beautiful Bill” (OBBB), a sweeping financial reform package now caught in the crossfire of digital asset regulation debates. While the bill originally aimed to redefine federal financial policy, it has become the latest battleground for lawmakers fighting over the future of U.S. crypto innovation.

Table of Contents

ToggleCrypto clauses create legislative gridlock

The OBBB has entered overtime in the Senate, where a growing list of crypto-related amendments is sparking division. Senator Cynthia Lummis has taken center stage, championing changes that would remove what she calls unfair double taxation on crypto users.

“For years, miners and stakers have been taxed TWICE,” Lummis posted on X. “Once when they receive block rewards, and again when they sell it. It’s time to stop this and ensure America is the world’s Bitcoin and Crypto Superpower.”

Lummis is also working on a proposal to protect U.S. citizens using digital assets for everyday purposes. Her second post confirmed efforts to introduce an amendment that would prevent Americans from being penalized for basic crypto transactions under outdated tax frameworks.

Opposition from Warren and Merkley stalls momentum

However, resistance from senators like Elizabeth Warren and Jeff Merkley has complicated the process. Their proposed counter-amendments focus on ethics, surveillance, and consumer protection—provisions that Lummis warns would “seriously harm American innovation and competitiveness.”

“If we are serious about ethics, let’s ensure digital assets receive the same treatment as other financial assets,” she wrote in a third public statement, pushing back against what she sees as overreach.

I appreciate my colleagues' concerns about ethics, but @SenWarren and @SenJeffMerkley’s amendment would seriously harm American innovation and competitiveness. If we are serious about ethics, let’s ensure digital assets receive the same treatment as other financial assets. pic.twitter.com/t4GsV04f7x

— Senator Cynthia Lummis (@SenLummis) June 30, 2025

The resulting impasse has slowed the OBBB’s path through the Senate, with lawmakers unable to agree on the scope of crypto regulation that should be embedded within the final text.

Elon Musk joins the political outcry

Adding fuel to the fire, Elon Musk criticized Congress for what he described as hypocrisy—supporting massive spending while stalling on innovation. In a viral post viewed over 26 million times, Musk declared:

Every member of Congress who campaigned on reducing government spending and then immediately voted for the biggest debt increase in history should hang their head in shame!

— Elon Musk (@elonmusk) June 30, 2025

And they will lose their primary next year if it is the last thing I do on this Earth.

“Every member of Congress who campaigned on reducing government spending and then voted for the biggest debt increase in history should hang their head in shame… and they will lose their primary if it’s the last thing I do.”

His comments have further politicized the bill, turning what began as a bipartisan economic package into a proxy war over the role of blockchain in America’s financial future.

Final Thoughts: What These Crypto Amendments Mean for U.S. Policy

The fate of the OBBB now hinges on how the Senate resolves the crypto debate. If pro-innovation amendments prevail, the U.S. could solidify its status as a global crypto leader, especially as Europe and Asia race ahead with regulatory clarity. But if the bill stalls—or if anti-crypto clauses dominate—the industry may face renewed uncertainty heading into the 2025 election cycle.

This showdown isn’t just about tax reform or financial ethics. It’s a defining moment in U.S. crypto policy—and the world is watching.