Spot XRP exchange-traded funds have continued to attract heavy demand, pulling in nearly $1 billion in inflows within weeks of their launch.

Despite this strong institutional appetite, the surge in ETF interest has not been enough to keep the asset above the psychological $2 threshold, with XRP’s price continuing to weaken.

XRP ETFs Extend Inflow Streak to 20 Consecutive Days

U.S.-listed spot XRP ETFs have now recorded inflows for 20 sessions in a row.

The products added more than $20 million on Friday, bringing cumulative inflows to just under $1 billion and pushing total assets above $1.2 billion.

The Franklin XRP ETF led the day, adding $8.7 million and lifting its net assets to $175 million.

Two other funds — Bitwise XRP ETF and Canary XRP ETF — also posted inflows, while others ended the day flat.

The steady stream of inflows has surpassed those of several other major crypto ETFs.

For comparison, spot Bitcoin ETFs added roughly $49 million on the same day, while spot Ether ETFs recorded outflows of more than $19 million.

Analysts say the momentum reflects increasing institutional interest in the asset.

“US spot $XRP ETFs have now recorded 20 straight days of inflows since launch, even as $BTC and $ETH ETFs continue to struggle with outflows,” analyst Bitcoinsensus noted.

“Institutional demand for XRP is heating up fast,” the analyst added.

Strong ETF Demand Fails to Halt Price Decline

Despite the wave of inflows, XRP’s price has been unable to maintain support at the $2 level.

The asset has been trending downward for more than a week, shedding over 11% in ten days and dipping below $2 for the second time since late November.

XRP is currently retesting an order block around $1.93.

Analysts say support at this level is weak, which could open the door to further losses.

Data suggests only a small amount of historical buying activity below $1.90.

This means fewer holders may be willing to defend the price in this zone.

The next major support cluster is around $1.78, where approximately 1.85 billion XRP were acquired.

If this level breaks, the price may slide further toward the $1.61 local low.

The 200-week exponential moving average is near $1.40 and is viewed as the final reliable support level if selling pressure accelerates.

Momentum Indicators Signal Further Weakness

XRP’s relative strength index has fallen to its lowest reading since July 2024.

This suggests bearish momentum is strengthening rather than stabilizing.

Analysts say that as long as the RSI remains depressed, a bounce is unlikely.

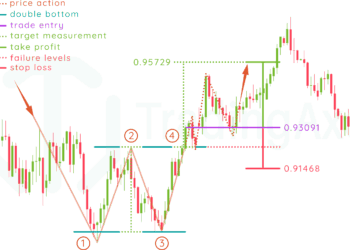

Technical models indicate that another break below $2 could trigger a move toward $1.75 and possibly extend the decline to $1.61.

Although ETF demand remains robust, traders are currently more focused on macro trends and risk sentiment across the broader crypto market.

If ETF inflows continue, some analysts believe they may eventually help stabilize price action, but for now XRP remains under pressure.