Several ambitious 2025 price predictions were set for VLXX coins by analysts across the world last year.

The year 2025 was a defining period for VLXX coin, marked by dramatic price swings and increased attention from cryptocurrency traders and investors. Originally considered a mid-cap token with potential in decentralized finance, VLXX captured market interest due to both its ambitious roadmap and the volatility typical of emerging digital assets.

2025 Market Performance

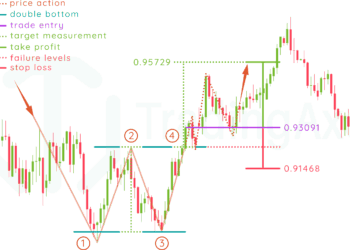

VLXX opened 2025 trading in the low single-digit range, reflecting cautious investor sentiment and relatively low trading volumes compared to major cryptocurrencies. Early in the year, price movements were modest, with the coin largely consolidating as the market digested global macroeconomic influences and the ongoing evolution of blockchain technology.

In the middle of the year, VLXX experienced sporadic surges fueled by short-term trading activity and speculative interest. These movements highlighted the token’s sensitivity to market sentiment and external crypto market trends. By late November and early December, the coin’s volatility intensified, culminating in a peak that captured trader attention.

By year-end 2025, VLXX had traded across a wide range, reflecting both the optimism of bullish investors and the caution of those concerned about market corrections. The coin ultimately closed the year in the mid-single-digit range, far below its short-term highs but higher than its early 2025 levels.

Key Price Milestones

The table below summarizes VLXX coin’s notable price points during 2025:

| Date / Period | VLXX Price (USD) | Notes |

|---|---|---|

| Early 2025 (Q1–Q3) | $1.20 – $1.50 | Consolidation with low volatility and steady trading volumes. |

| Late November 2025 | $0.90 – $2.80 | Increased volatility and speculative trading. |

| Early December 2025 | $5.00 – $12.50 | Bullish spike fueled by momentum trading. |

| December 15, 2025 | ~$18.40 | Short-term all-time high driven by trading frenzy. |

| Year-End 2025 | ~$6.20 | Market consolidation and stabilization after peak. |

Factors Driving 2025 Volatility

Several key factors contributed to VLXX’s behavior in 2025:

- Speculative Trading: Much of the dramatic price movement stemmed from short-term trading activity. As liquidity increased in certain exchanges, the coin experienced amplified swings.

- Market Sentiment: Investor optimism about decentralized finance projects and blockchain adoption fueled demand for VLXX at certain points, while broader crypto market corrections temporarily dampened enthusiasm.

- Technological Updates: Incremental upgrades to the VLXX network and announcements regarding partnerships created bursts of interest but did not fully stabilize long-term valuation.

Future Outlook: 2026 and Beyond

Looking ahead, analysts suggest that VLXX’s trajectory will depend on a combination of adoption, market sentiment, and broader crypto market trends.

Bullish Scenario

If VLXX succeeds in expanding its use cases and attracting institutional interest, the coin could experience moderate to strong growth. Optimistic projections see potential price targets in the $15–$25 range within 2026, assuming sustained adoption and continued market support.

Conservative Scenario

Should the coin face market corrections or slower adoption, it may trade in a more restrained range, roughly $5–$10, reflecting consolidation after 2025’s volatility. Investors in this scenario may benefit from a long-term hold strategy focused on network developments rather than short-term speculation.

Key Considerations for Investors

- Volatility Risk: VLXX remains a highly volatile asset, with sharp swings possible even within a single trading day.

- Adoption Metrics: The coin’s future depends heavily on usage within decentralized finance ecosystems and broader blockchain applications.

- Market Conditions: Interest rates, macroeconomic trends, and crypto market cycles will continue to influence VLXX price dynamics.

Conclusion

2025 was a year of both opportunity and caution for VLXX coin. While the token experienced periods of spectacular gains, it also demonstrated the volatility inherent in mid-cap cryptocurrencies.

Investors looking to engage with VLXX in 2026 and beyond should monitor adoption trends, technological developments, and overall market sentiment. Balanced strategies, including risk management and diversification, remain critical for those navigating this dynamic and unpredictable asset.