Investment specialist 5StarsStocks.com has highlighted the burgeoning theme of 3D‑printing stocks as a compelling opportunity for growth investors.

Its top-stock lists emphasise companies involved in additive manufacturing — whether hardware, software, materials, or services — that stand to benefit from broader adoption of print-based manufacturing.

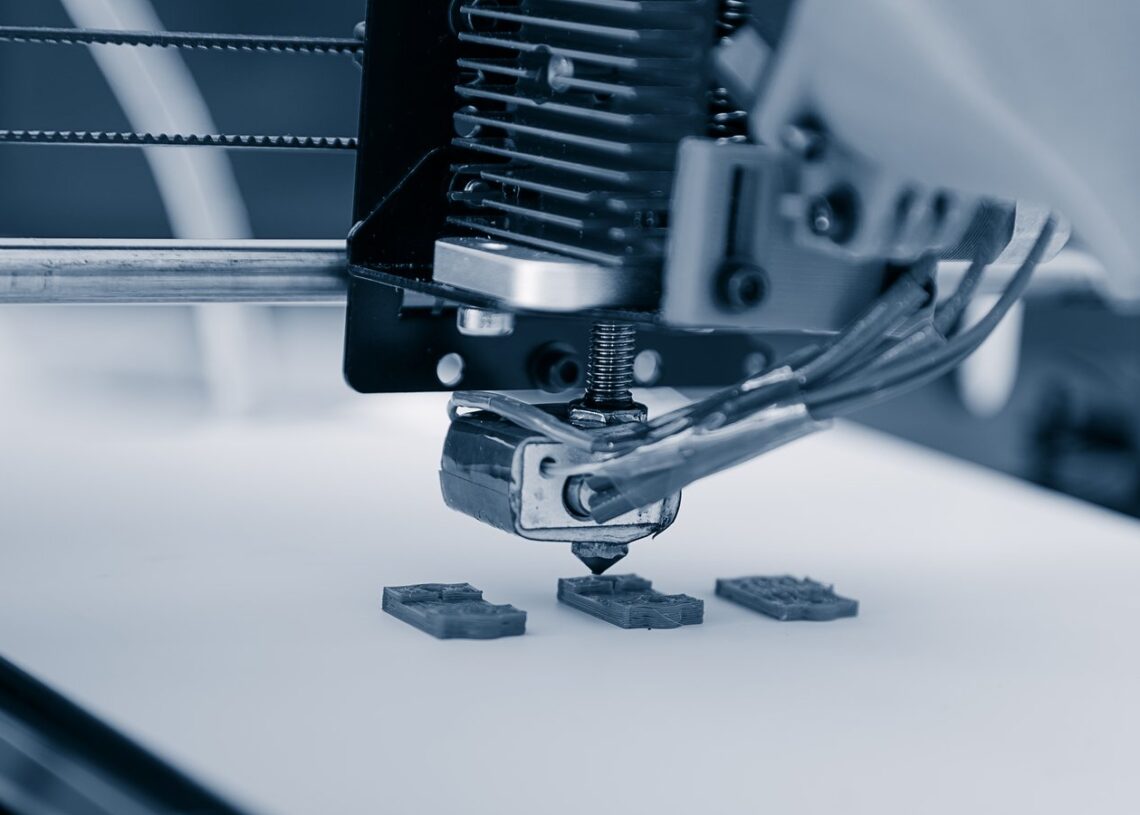

The platform’s core idea is that 3D printing is no longer a niche prototyping tool but is evolving into full-scale industrial production, medical implants, and on-demand manufacturing.

As such, 5StarsStocks.com presents its curated list of stocks, combined with research-driven ratings, to help investors navigate the space.

The Growth Narrative

The rationale behind focusing on 3D printing is anchored in several converging trends.

First, the global additive-manufacturing market is forecast to grow strongly as technologies mature, costs decline, and applications expand.

Second, 3D printing’s intrinsic flexibility — custom geometries, reduced waste, fewer tooling constraints — is attractive to industries such as aerospace, automotive, healthcare, and consumer goods.

Third, emerging materials (metals, composites, bioprinting) and software tools mean the sector is shifting from prototyping to actual production — a transition that heralds larger revenue potential for leading firms.

Consequently, 5StarsStocks.com and similar analysts argue that selecting the right players today could yield significant upside over a multi-year horizon.

How 5StarsStocks.com Approaches 3D Printing Stocks

5StarsStocks.com uses a rating framework that combines quantitative and qualitative inputs.

It assesses fundamentals such as revenue growth, profitability, and R&D spending, alongside strategic factors like patents, partnerships, and sector focus.

Market context is also evaluated, including industry growth rate and competitive positioning.

The site builds profiles for each featured company, describing their business model, technology stack, growth strategy, and risks.

This approach helps users not just pick stocks but understand why those names may outperform.

Importantly, the platform emphasises diversification within the 3D‑printing theme — hardware versus software, industrial versus healthcare, polymer versus metal.

By doing so, it aims to mitigate concentration risk and provide exposure to multiple segments of the ecosystem.

Standout Companies in the 3D Printing Theme

Several firms recur in 5StarsStocks.com’s top lists.

Stratasys Ltd. is one of the pioneers in polymer-based 3D printing. Its machines are widely used in industrial prototyping, aerospace components, and healthcare applications, offering a mix of hardware and software solutions.

3D Systems Corporation provides a range of additive manufacturing solutions, from printers to software and materials. It has a broad industrial and medical footprint, making it a staple in the 3D printing sector.

Desktop Metal, Inc. focuses on metal additive manufacturing. Its technology enables cost-efficient production of complex metal parts, which is increasingly used in automotive, aerospace, and industrial tooling.

Materialise NV is a software-driven company enabling 3D printing applications across healthcare and industrial markets. Its software platforms optimize workflows, design simulations, and production scalability.

ExOne Company specializes in binder-jetting 3D printing technology for metals and sand, targeting industrial manufacturing, automotive parts, and large-scale production components.

These companies collectively represent a balanced exposure across hardware, software, materials, and industrial applications.

Investment Considerations

Investing in 3D printing stocks comes with notable upside potential, but also certain risks.

Market adoption remains uneven across sectors. While aerospace and healthcare see rapid uptake, other industries may adopt more slowly due to cost, training, or integration challenges.

Technological competition is intense. Startups and established players alike compete on machine accuracy, material diversity, and speed.

Financial volatility is another factor; many companies in the 3D printing space are investing heavily in R&D, which can impact short-term profitability.

Regulatory factors, particularly in healthcare and aerospace, must also be monitored as they can influence market expansion.

5StarsStocks.com advises a balanced approach, combining growth-oriented companies with stable, diversified players to manage risk while capitalizing on the sector’s potential.

Why 3D Printing Stocks Matter

3D printing represents a shift from traditional manufacturing to flexible, on-demand production.

It reduces material waste, shortens supply chains, and enables custom parts that are difficult or impossible to produce using conventional methods.

For investors, this translates into companies that can benefit from industrial trends, technological innovation, and sector diversification.

5StarsStocks.com provides insight into this evolving landscape, helping investors understand which companies are well-positioned for long-term growth.

Conclusion

The 3D printing sector offers a compelling investment narrative driven by innovation, industrial adoption, and technological advancement.

5StarsStocks.com’s curated stock lists and research provide investors with tools to navigate this dynamic market.

By understanding the business models, technology strengths, and growth potential of key companies, investors can make informed decisions within a sector poised for expansion.

Diversified exposure across hardware, software, materials, and industrial applications allows for risk management while capitalizing on long-term trends.

For those looking to combine growth potential with technological innovation, 3D printing stocks highlighted by 5StarsStocks.com represent a sector worth following closely.