In a sweeping move that could transform how digital assets are regulated in the United States, the Securities and Exchange Commission (SEC) has officially launched Project Crypto, a policy initiative aimed at rewriting the rulebook for digital assets, staking services, and decentralized finance (DeFi). The announcement, delivered by SEC Chair Hester Atkins during her July 31 remarks on the Digital Finance Revolution, signals a significant departure from the agency’s previous posture.

This new initiative promises a more tailored and transparent regulatory framework for Web3 developers, exchanges, and token issuers operating within the U.S.

What Is Project Crypto?

According to the official SEC speech transcript, Project Crypto is a multi-phase regulatory overhaul that focuses on defining the scope of securities laws in relation to emerging crypto technologies. Chair Atkins emphasized the urgency of adapting legacy financial rules to the realities of blockchain innovation, saying:

“We cannot continue to regulate 21st-century innovation with 20th-century rules. Project Crypto is our commitment to build smarter, clearer, and more agile frameworks for this transformative sector.”

Project Crypto is not a single rule or enforcement action. Instead, it will guide future regulatory decisions across several key areas: staking, tokenization, custody, disclosures, and the intersection of DeFi protocols with securities laws.

New Clarity on Staking Activities

One of the immediate implications of Project Crypto is a sharper focus on staking. A few days before the initiative was unveiled, the SEC also released a policy statement on staking, signaling that protocol-level staking rewards could fall outside the traditional definition of investment contracts.

This nuanced view marks a soft pivot from the enforcement-driven posture that previously led to high-profile lawsuits against Coinbase, Kraken, and others over staking services. Under Project Crypto, staking programs may see more defined classifications depending on protocol design and user disclosures.

Building on the White House’s Strategic Framework

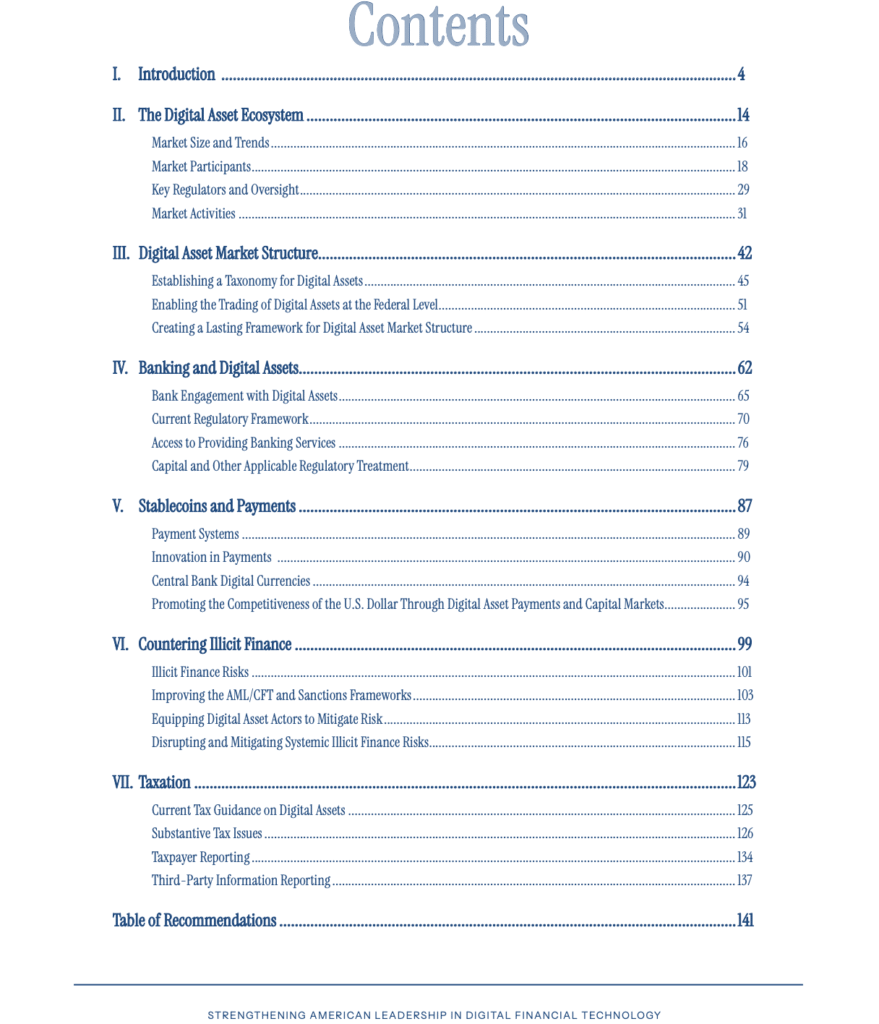

The launch of Project Crypto closely follows the release of the Biden administration’s updated digital assets policy roadmap, outlined in the White House’s Digital Assets Report (EO 14178). The report called for greater interagency collaboration to ensure that the U.S. leads in financial innovation while managing systemic risks posed by digital assets.

Source: White House

Project Crypto aligns with those goals, especially in its intent to clarify which digital assets are securities, which are commodities, and which may fall into new regulatory categories. Atkins noted that “federal clarity must support, not suppress, innovation.”

What Project Crypto Means for Token Issuers and Exchanges

Token issuers and centralized exchanges will likely be among the first to feel the impact of this new initiative. With Project Crypto, the SEC aims to create streamlined registration pathways for token projects, minimizing the current ambiguity that has left many founders unsure whether their assets fall under federal oversight.

Exchanges may also see a clearer separation between trading platforms dealing in securities and those dealing in digital commodities. This could pave the way for more compliant token listings—and fewer enforcement actions—if the framework delivers on its promise.

However, Atkins made it clear that compliance will remain non-negotiable. She also warned that any project seeking to sidestep the U.S. legal framework entirely “will be treated accordingly.”

Industry Reaction and Outlook

Initial reactions from the crypto industry appear cautiously optimistic. Many developers and legal analysts had long criticized the SEC’s “regulation by enforcement” strategy, which created fear rather than clarity. Project Crypto, at least in its early communications, signals a more pragmatic and dialogue-driven approach.

Crypto lawyer Jake Chervinsky called the move “a long-overdue step toward regulatory sanity.” Meanwhile, crypto Twitter reacted with mixed feelings, praising the attempt to modernize while expressing skepticism over how implementation will unfold.

The roadmap also suggests that additional guidance may be issued by the end of Q4 2025, potentially leading to the release of new rulemaking proposals in early 2026.

Final Thoughts: What Project Crypto Could Mean for U.S. Crypto Leadership

With Project Crypto, the SEC has taken a bold step toward modernizing its approach to digital assets. If implemented effectively, it could reduce regulatory uncertainty, attract more builders back to U.S. soil, and create pathways for innovation that don’t end in courtrooms.

That said, execution will be key. Crypto entrepreneurs will be watching closely for concrete follow-through beyond speeches and reports. Until then, Project Crypto remains a promising—but still developing—turning point in U.S. crypto regulation.