Investors have been sharing their thoughts about NWBO on StockTwits, including price predictions and market sentiment.

Northwest Biotherapeutics, commonly referred to by its stock ticker NWBO, has been drawing attention on investor discussion platforms, particularly StockTwits, as market participants monitor its clinical developments and stock performance.

NWBO is a biotechnology company focused on developing immunotherapy treatments for cancer, including experimental vaccines aimed at glioblastoma, one of the most aggressive forms of brain cancer. The company’s progress in clinical trials, regulatory updates, and investor communications often drives activity on social media and financial discussion platforms.

NWBO StockTwits Trends

StockTwits is a platform where traders and investors share short-form commentary on publicly traded companies. For NWBO, the discussion often centers around the company’s latest trial results, expected regulatory decisions, and stock volatility.

Investors on StockTwits have highlighted both the potential upside and risks associated with NWBO. Positive sentiment typically revolves around preliminary clinical data that suggests the company’s therapies could provide meaningful benefits to patients. Optimistic users discuss the potential for the stock to rise significantly if the company achieves key clinical milestones or enters into partnerships with larger pharmaceutical firms.

At the same time, some investors caution that biotechnology stocks like NWBO are highly speculative. Delays in clinical trials, regulatory setbacks, or insufficient funding could negatively impact stock performance. StockTwits conversations frequently reflect this dichotomy, with bullish and bearish perspectives appearing side by side.

Recent NWBO Developments

The activity around NWBO on StockTwits often mirrors real-world developments. Any announcements regarding clinical trial phases, patient enrollment numbers, or safety data can trigger spikes in discussions and increased trading interest.

For example, news that NWBO is advancing to a new phase in its immunotherapy research generally generates optimism among retail investors. Many users speculate on how these developments could translate into revenue growth, potential licensing agreements, or even acquisition interest from larger biotechnology companies.

Conversely, reports of trial delays, funding needs, or missed regulatory milestones tend to generate caution. StockTwits users often discuss stop-loss strategies or debate the long-term viability of investing in NWBO, reflecting the inherent uncertainty in the biotechnology sector.

Market Volatility

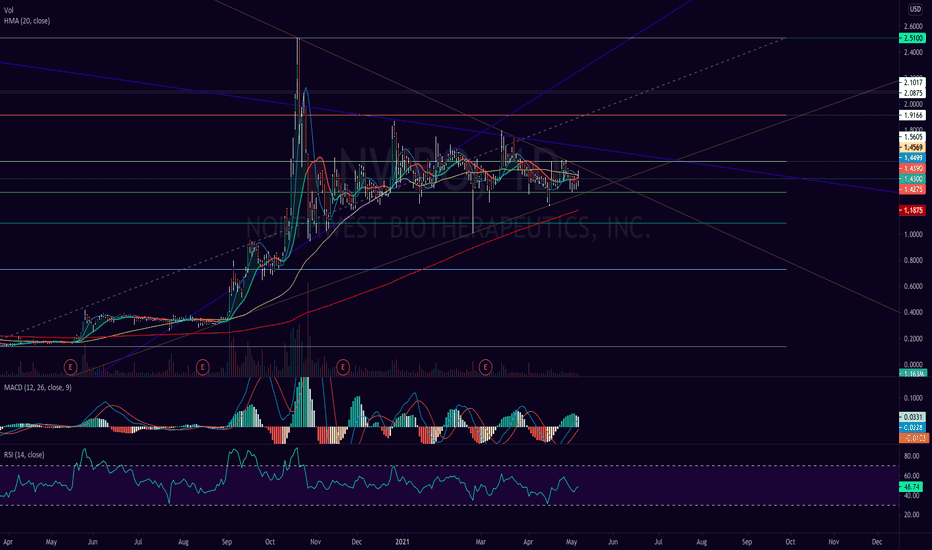

NWBO is considered a volatile stock, and this volatility is reflected in online conversations. Price swings often prompt rapid discussion on StockTwits, with traders analyzing technical indicators, recent trading volume, and short interest to inform their opinions.

The company’s small market capitalization compared to larger pharmaceutical firms contributes to these fluctuations. As a result, NWBO shares can experience significant intraday movements, attracting traders looking for short-term gains as well as long-term investors focused on the company’s scientific progress.

NWBO Investor Sentiment on StockTwits

Investor sentiment on StockTwits tends to follow a pattern common among small-cap biotech stocks: high optimism when positive data emerges and caution when uncertainties arise. This makes NWBO a stock where social media sentiment can be particularly pronounced.

Some users actively share analyses comparing NWBO’s trial results with similar immunotherapy developments in the broader biotech sector. Others focus on potential catalysts, such as upcoming investor presentations, peer-reviewed publications, or regulatory announcements, which they believe could influence stock price in the near term.

While sentiment can be an important indicator of market mood, experienced investors caution against relying solely on social media discussions for decision-making. Biotech stocks like NWBO carry unique scientific and regulatory risks that may not be fully captured in short-form commentary.

Long-Term Considerations

Long-term investors in NWBO are primarily focused on the company’s pipeline and ability to bring products to market. Success in clinical trials and regulatory approval could substantially increase the company’s valuation and justify optimism seen on platforms like StockTwits.

However, the path to commercialization for biotech firms is often lengthy and uncertain. Factors such as funding requirements, competitive landscape, and broader market conditions can all impact NWBO’s long-term prospects. Investors monitoring StockTwits are often balancing short-term price movements with these longer-term considerations.

Overview

NWBO has generated notable attention on StockTwits, reflecting both interest in the company’s immunotherapy developments and the stock’s inherent volatility. Conversations range from optimistic projections of potential breakthroughs to cautious warnings about clinical and regulatory challenges.

While social media sentiment can offer insights into investor mood, it is important for market participants to also consider the fundamental aspects of NWBO’s pipeline, financial health, and regulatory environment.

For traders and investors alike, NWBO represents a high-risk, high-reward opportunity where both short-term social media trends and long-term scientific progress play significant roles in shaping potential outcomes.

The activity on StockTwits provides a real-time window into market perception, but the company’s future performance will ultimately be determined by the success of its clinical programs and strategic execution.