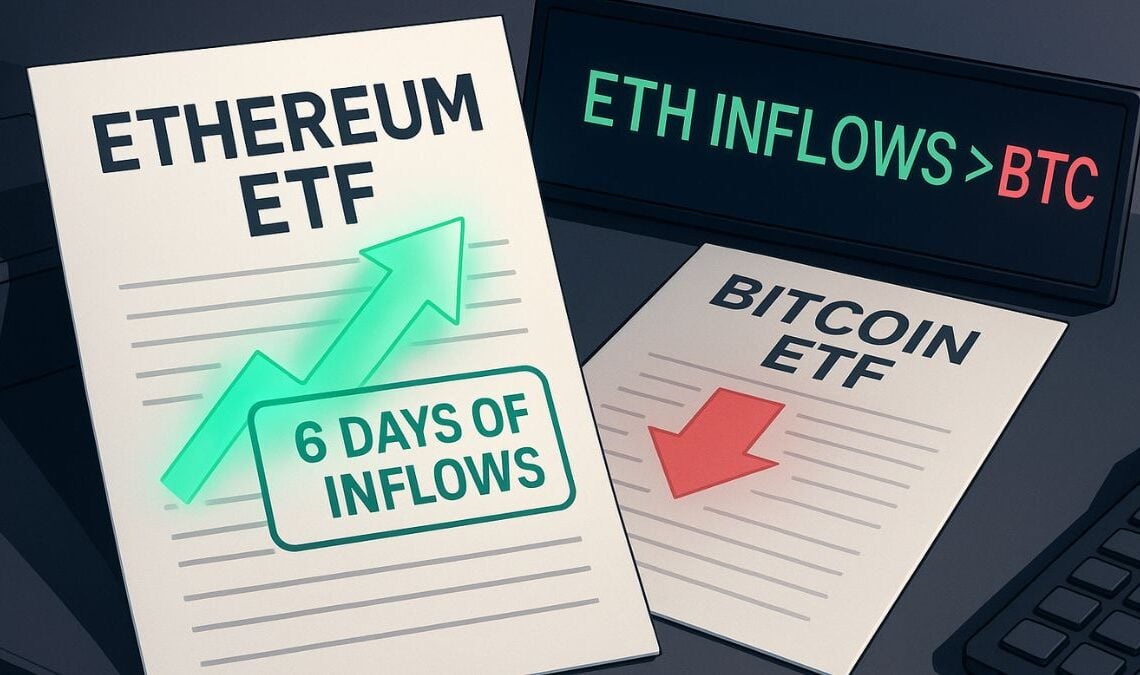

In a rare market dynamic, ETH ETF inflows have overtaken Bitcoin for six consecutive trading sessions, signaling a potential shift in investor sentiment. According to data aggregated from major U.S. issuers, Ethereum-focused ETFs pulled in more net inflows than their Bitcoin counterparts from July 18 to July 24, 2025. This development is not just statistically unusual it could mark the early stages of Ethereum stepping out of Bitcoin’s shadow.

While Bitcoin remains the dominant crypto asset by market cap, Ethereum appears to be making quiet but firm strides in institutional relevance. Daily ETF data reveals that BlackRock’s ETHA, Fidelity’s FETH, and VanEck’s CETHV were among the most consistent contributors to Ethereum’s six-day winning streak.

ETH ETF Inflows Point to Growing Institutional Confidence

The recent ETF flows paint a clear picture: institutions are increasingly looking at Ethereum as a credible long-term asset not just a secondary play to Bitcoin. On July 24 alone, ETH ETFs recorded $210.1 million in inflows compared to Bitcoin ETF outflows. Over the six-day period, cumulative ETH ETF inflows exceeded $1 billion, compared to a relatively stagnant performance on the Bitcoin side.

Source: Farside Investors

This divergence isn’t just a quirk of the market. It reflects growing institutional belief in Ethereum’s evolving fundamentals from the migration to Proof of Stake to its critical role in the decentralized finance (DeFi) and layer-2 ecosystem.

ETF analyst Eric Balchunas commented that this streak, while still early, “may signal a quiet rotation, especially among forward-looking institutional players looking beyond store-of-value narratives.”

Ethereum Price Outlook: Can ETH Sustain Its Momentum?

Looking at Ethereum’s price action, the cryptocurrency has recently cooled off from its July peak near $3,850. The attached TradingView chart shows a slight pullback to around $3,600, but the broader trend remains bullish. Since bottoming in April, ETH has rallied nearly 100%, supported by growing DeFi activity and optimism around ETF adoption.

Should the ETH ETF inflow trend persist, it could act as a new source of demand and price stability something ETH historically lacked during volatile periods.

Source: Trading View

However, traders are keeping a close eye on support around $3,500. If that level holds, we could see a renewed push toward the $4,000 psychological barrier. A break above that could reignite momentum toward the $4,400–$4,800 zone last visited during the 2021 bull cycle.

On the downside, failure to hold $3,500 could see ETH retesting the $3,200–$3,000 region, where volume support is clustered.

Is Ethereum Finally Ready to Lead?

For years, Ethereum has been viewed as Bitcoin’s younger, more experimental sibling powerful but unpredictable. But with consistent ETH ETF inflows, rising developer activity, and a maturing L2 landscape, Ethereum is finally beginning to demonstrate the characteristics of a macro asset.

More interestingly, the ETH ETF trend also reflects a broader market narrative: the transition from static store-of-value assets to yield-generating, utility-focused platforms. Ethereum is no longer just about gas fees and DeFi it’s increasingly seen as the infrastructure backbone for Web3.

Institutional investors, who once saw ETH as too volatile or “too techy,” are beginning to recalibrate. The rotation into ETH ETFs might be early evidence of this shift.

Final Thoughts: What the ETH ETF Trend Means for Ethereum’s Future

This six-day streak of ETH ETF dominance may be more than a blip it could represent the start of a new investment era. With inflows rising and price holding key levels, Ethereum is stepping into a leadership role once solely held by Bitcoin.

Investors should monitor whether this trend continues into early August. If so, we may look back on this stretch as the inflection point where ETH began its long-term decoupling from BTC not just in technology, but in capital flows.