Kazakhstan is taking a bold step into the digital asset world. The Central Asian nation has revealed plans to diversify its national reserves, allocating portions to cryptocurrencies, gold, and foreign currencies. According to a televised announcement from national authorities, the move reflects a broader Kazakhstan to invest strategy that aligns with models adopted by sovereign wealth funds in countries like Norway and the United States.

This development marks a significant pivot in Kazakhstan’s financial policy. Historically reliant on commodity exports, particularly oil and gas, the country is now seeking to modernize its economic foundation through a more diversified reserve structure. The strategy includes digital assets—particularly Bitcoin—as long-term stores of value and hedges against inflation and dollar exposure.

A Strategic Shift Inspired by Global Examples

Kazakhstan’s new plan mirrors the portfolio strategies employed by institutions like Norway’s Government Pension Fund and the U.S. State of Wisconsin Investment Board, both of which have reported increasing exposure to crypto-related instruments.

Officials from the Samruk-Kazyna National Welfare Fund, Kazakhstan’s sovereign wealth entity, stated during a recent policy briefing that the decision to explore crypto and gold as reserve assets stems from the need to reduce reliance on traditional fiat instruments. The shift is intended to enhance resilience against global economic shocks, especially as inflation and interest rate uncertainty remain high worldwide.

In a recent segment aired by Kazakhstan’s national media (source), representatives explained that up to 5% of reserve holdings could be allocated to digital assets and blockchain-related investments over the next 24 months. This would place Kazakhstan among the first emerging economies to actively use crypto as part of its sovereign financial framework.

Central Bank’s Role and Regulatory Oversight

The National Bank of Kazakhstan (NBK) will play a supervisory role in evaluating risk thresholds, ensuring asset transparency, and liaising with foreign custodians. The country already has an experimental regulatory sandbox for digital asset projects via the Astana International Financial Centre (AIFC), which is likely to serve as the main pipeline for crypto allocations.

Analysts suggest that Kazakhstan’s previous investment in crypto mining infrastructure—despite recent energy tensions—may have paved the way for this bolder reserve strategy. The country has been one of the top five nations for Bitcoin hash rate in recent years.

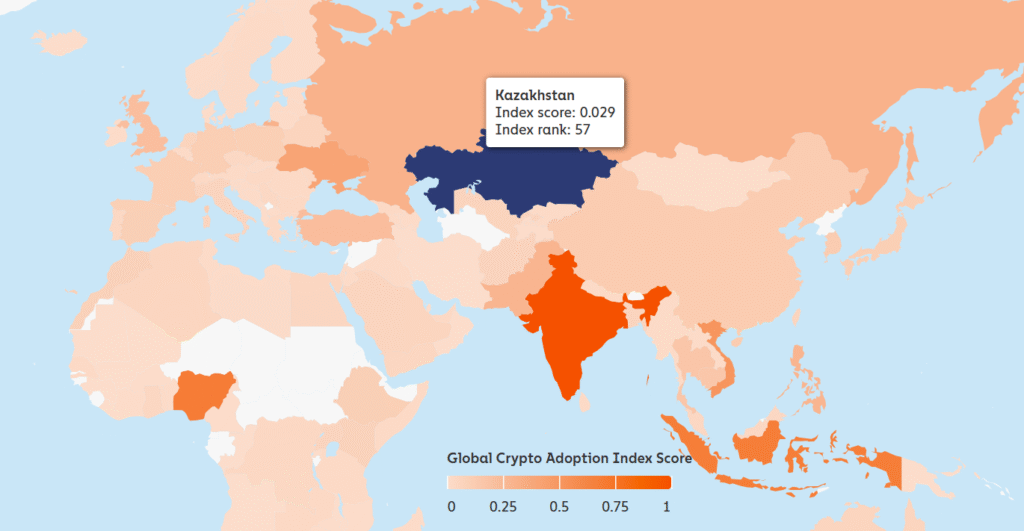

Kazakhstan still lags behind many other countries in terms of retail crypto adoption. Source: Chainalysis

However, officials stressed that this Kazakhstan to invest policy does not signal a full embrace of crypto as legal tender. Rather, it reflects an evolving approach to diversification in sovereign finance, one that carefully integrates select risk-adjusted digital assets.

Why Crypto, Why Now?

Several factors have prompted this strategic reserve recalibration:

- Weakening confidence in fiat currencies amid global debt escalation.

- Crypto adoption by major sovereign funds, giving legitimacy to the asset class.

- Kazakhstan’s positioning as a regional crypto hub, especially within Central Asia.

According to experts, crypto assets like Bitcoin and Ethereum may serve as a long-term counterbalance to the country’s oil-exposed economy. Coupled with increased demand for gold and foreign exchange reserves, the pivot suggests a forward-looking monetary policy shift.

Final Thoughts: Kazakhstan to Invest in a New Financial Future

The Kazakhstan to invest narrative is no longer just about infrastructure or mining—it now extends to strategic asset allocation at the highest level of state finance. If executed prudently, this move could enhance Kazakhstan’s global financial standing and provide a roadmap for other emerging economies to follow.As the world watches how these investments unfold, Kazakhstan may soon join the ranks of sovereign funds that have successfully embraced crypto as part of their financial future.