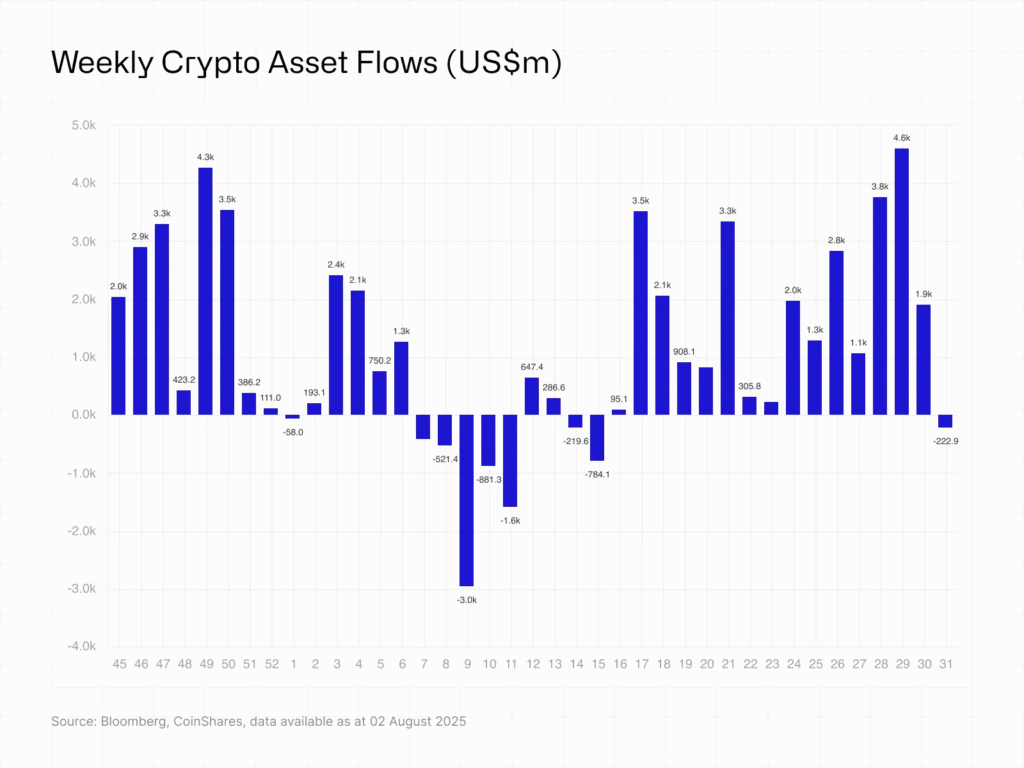

After 15 straight weeks of inflows, crypto funds have finally run out of steam—at least for now. According to CoinShares, digital asset investment products recorded a significant $223 million in outflows, marking the first red week in over three months. This sudden reversal is raising eyebrows across the industry and prompting one big question: is the Fed killing the bull run before it can fully take off?

Table of Contents

ToggleInstitutional Appetite for Crypto Funds Cools Off

The latest figures show that crypto funds have lost momentum at a critical time. The outflows come just after digital assets had enjoyed a solid 15-week inflow streak, totaling over $4.5 billion in new capital. That momentum has now been broken.

Notably, Bitcoin accounted for over $220 million of the total weekly outflows, indicating that institutional investors are scaling back positions in the flagship asset. Ethereum, which had been showing modest signs of revival, also recorded minor outflows.

According to Matrixport, the shift in capital could reflect traders hedging against incoming macro shocks rather than an outright loss of confidence in digital assets.

Fed Pressure and Macroeconomic Tension

So, what changed? Most fingers are pointing directly at the Federal Reserve.

Weekly crypto asset flows. Source: CoinShares

The market’s risk sentiment has been rattled by signals from last week’s FOMC policy stance. Fed officials maintained a cautious tone regarding future rate cuts, which chilled enthusiasm in risk-on assets like crypto. Simultaneously, investors are grappling with broader macroeconomic uncertainty, including new trade tariffs. The White House recently announced adjustments to reciprocal tariff rates, further injecting uncertainty into global markets.

These overlapping variables have triggered a mild flight to safety, prompting large-scale liquidations of volatile assets—including crypto funds.

Altcoins and Blockchain Equities Weren’t Spared

While Bitcoin dominated the outflows, smaller digital assets didn’t escape unscathed. Solana, XRP, and Cardano each posted minor outflows, reflecting a broader pullback across the altcoin landscape.

Blockchain equities were also affected. According to the same CoinShares report, public companies with direct exposure to blockchain infrastructure and token custody saw modest outflows—suggesting that traditional finance exposure to crypto is also under pressure.

The timing is particularly sensitive, as August historically tends to be a low-volume month with fewer catalysts. That makes the Fed’s influence even more pronounced on short-term sentiment.

A Pause or a Reversal?

Despite the weekly outflows, the long-term narrative hasn’t completely broken. Total crypto fund assets under management (AUM) remain elevated, and year-to-date inflows are still firmly positive.

Some analysts argue this may simply be a technical cooling-off period, especially after such a strong 15-week run. Others believe this could be the start of a broader consolidation phase before the next leg up—especially as ETF demand normalizes and Bitcoin hovers below major resistance levels.

If upcoming inflation data shows cooling prices or the Fed softens its tone, capital could once again rotate into crypto funds. However, if the current hawkish bias persists, it could cap upside potential in the near term.

Final Thoughts: What $223M Outflows Mean for Crypto Funds

The sudden outflow from crypto funds is a reminder that even in bullish cycles, macro factors still dominate market direction. With the Fed casting a long shadow and geopolitical uncertainty on the rise, investors are being more selective with risk.Yet, it’s worth noting that this pullback doesn’t erase the broader trend of institutional adoption. From ETF inflows to growing on-chain metrics, digital assets continue to gain traction. The next few weeks will be critical in determining whether this is just a pause—or the beginning of a larger sentiment shift.