In a surprising regulatory about-face, the Bitwise ETF has been approved — and then immediately paused — by the U.S. Securities and Exchange Commission (SEC), according to official filings published on July 22.

The sudden move has raised eyebrows across the crypto and ETF investment communities, leaving market participants questioning the SEC’s current stance on digital asset products.

Bitwise ETF: Sudden Approval Followed by Freeze

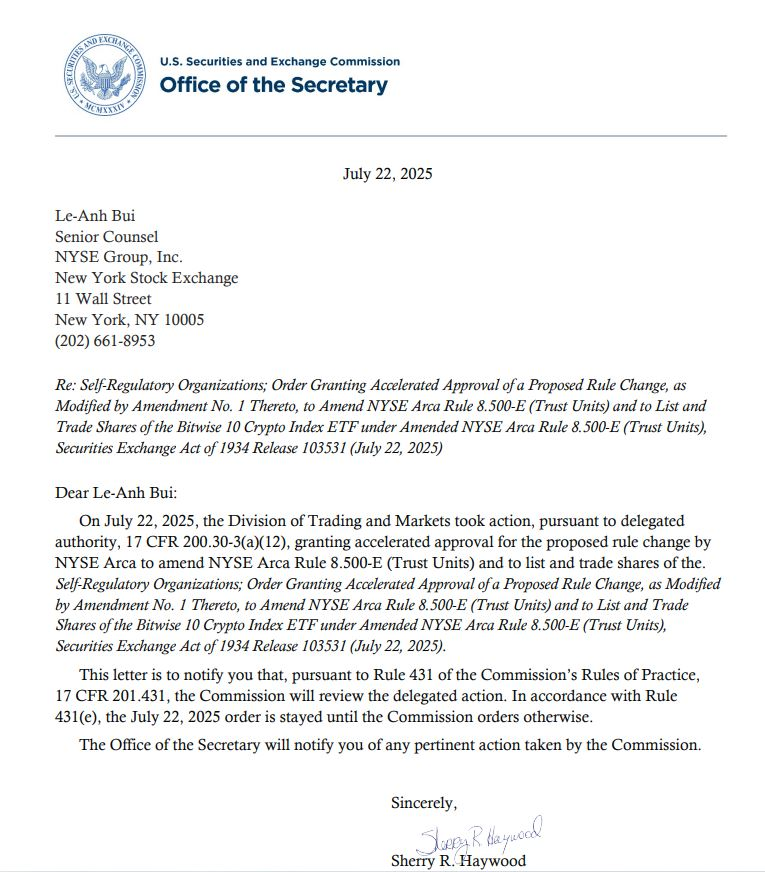

The drama unfolded when the SEC officially granted approval to Bitwise’s application to convert its existing fund into a spot Bitcoin ETF. However, within hours, the Commission issued a follow-up notice placing the approval on hold, citing “additional considerations” under Rule 431 of NYSE Arca.

SEC assistant secretary Sherry Haywood paused the approval of Bitwise’s crypto index fund pending a review. Source: SEC

his dual-action by the SEC effectively means that the Bitwise ETF is now in regulatory limbo, technically approved but not allowed to proceed with its listing or investor onboarding until further notice.

Plot thickens on Grayscale Digital Large Cap ETF…

— Nate Geraci (@NateGeraci) July 12, 2025

SEC Division of Trading & Markets issued approval order on July 1st.

*Should* have been the end of it & GDLC would be live.

But that approval order was then stayed.

Grayscale attorneys aren’t having it. Sent letter to SEC. pic.twitter.com/gsQgp0kqyp

Financial analyst Nate Geraci reacted to the event by calling it “one of the most confusing ETF rulings in recent memory,” hinting at internal disagreements within the regulatory body or unexpected pushback.

What Rule 431 Means — And Why It Matters

Rule 431 allows the SEC to delay an approved exchange rule change if new information emerges or if the Commission deems that additional review is needed to protect investors or maintain market integrity.

The specific reason for the SEC’s reversal on the Bitwise ETF remains unclear. However, some speculate that internal concerns over custody mechanisms, redemption processes, or fund composition may have sparked the delay.

Bitwise’s proposal initially appeared to align with existing spot ETF structures, especially following the successful launches of Bitcoin and Ethereum ETFs earlier in 2025. Its swift freeze has now cast doubt on the consistency of the Commission’s approach to digital asset regulation.

Market Implications for Crypto ETFs

The move could shake confidence in the current wave of crypto ETF filings and approvals. While Bitwise is the immediate target, the pause might signal a more cautious or fragmented approach within the SEC — potentially affecting future filings like those of 21Shares, Grayscale, and Hashdex.

With total crypto assets under management exceeding $80 billion and ETF demand growing rapidly, such unpredictability from regulators adds volatility to an already fragile trust landscape.

Bitwise, for its part, has yet to release an official statement. Analysts suggest the firm will likely comply with any additional information requests while continuing to work toward a full green light in the coming weeks.

Why the Bitwise ETF Still Matters

Even in regulatory limbo, the Bitwise ETF remains one of the most anticipated products in the market. Bitwise has positioned itself as a leader in crypto index investing, and the approval (even if paused) sets a precedent for eventual conversion of multiple crypto trust products into exchange-traded vehicles.

Institutional investors are particularly interested in in-kind redemption models — an issue that has been controversial in the SEC’s recent dealings with both Bitcoin and Ethereum ETFs. The pause may indicate a fresh regulatory bottleneck for funds pursuing those operational structures.

Final Thoughts: Bitwise ETF Faces the Long Game

Although the sudden freeze on the Bitwise ETF surprised the market, it may ultimately reflect the SEC’s evolving standards rather than outright rejection. With increasing pressure from lawmakers, asset managers, and retail investors alike, it’s likely the product will resume progress in due time.Still, this episode serves as a reminder that even approved crypto products can face unpredictable regulatory hurdles, especially in the U.S. — where clarity often lags behind innovation.