Bitcoin experienced heightened volatility on Thursday as traders responded to unexpected US inflation data.

The cryptocurrency climbed above $89,000 before reversing course, reflecting sudden swings in market sentiment.

The Consumer Price Index (CPI) for November showed a decline that defied expectations, representing one of the largest monthly drops since 2023.

“The all items index rose 2.7 percent for the 12 months ending November, after rising 3.0 percent over the 12 months ending September,” the US Bureau of Labor Statistics reported.

October’s CPI report was not released due to the government shutdown, leaving November’s data as the primary focus.

Traders highlighted that Core CPI inflation in the US is now at its lowest level since March 2021.

“This puts Core CPI inflation in the US at its lowest level since March 2021,” trading resource The Kobeissi Letter said on X.

The report suggested inflation is nearing the Federal Reserve’s 2% target for the first time since the pandemic.

“This should be very welcomed by the Fed. More rate cuts are expected to get priced in following this data,” crypto trader Daan Crypto Trades noted.

CME Group’s FedWatch Tool showed a 26.6% probability of a rate cut at the Fed’s January 28 meeting.

Volatility Patterns and Market Reactions

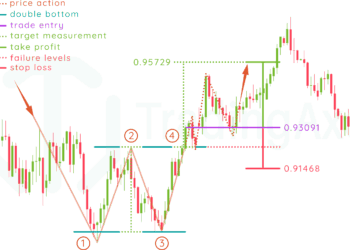

Bitcoin traders remain cautious after observing repeated “fakeouts” earlier in the week.

The erratic price movement has prompted concerns about market manipulation around key liquidity levels.

Total crypto liquidations exceeded $630 million in the 24 hours following the CPI release, according to CoinGlass.

Some analysts note parallels to early 2025, suggesting the possibility of a macro bottom forming for BTC/USD.

“$BTC is mimicking the Q1 2025 fractal. What if this plays out?” crypto entrepreneur Ted Pillows remarked, referencing historical price patterns.

A potential return to levels below $75,000 remains a scenario for traders tracking the fractal behavior.

Market participants are watching closely as interest rate expectations and inflation data continue to drive short-term volatility in crypto markets.