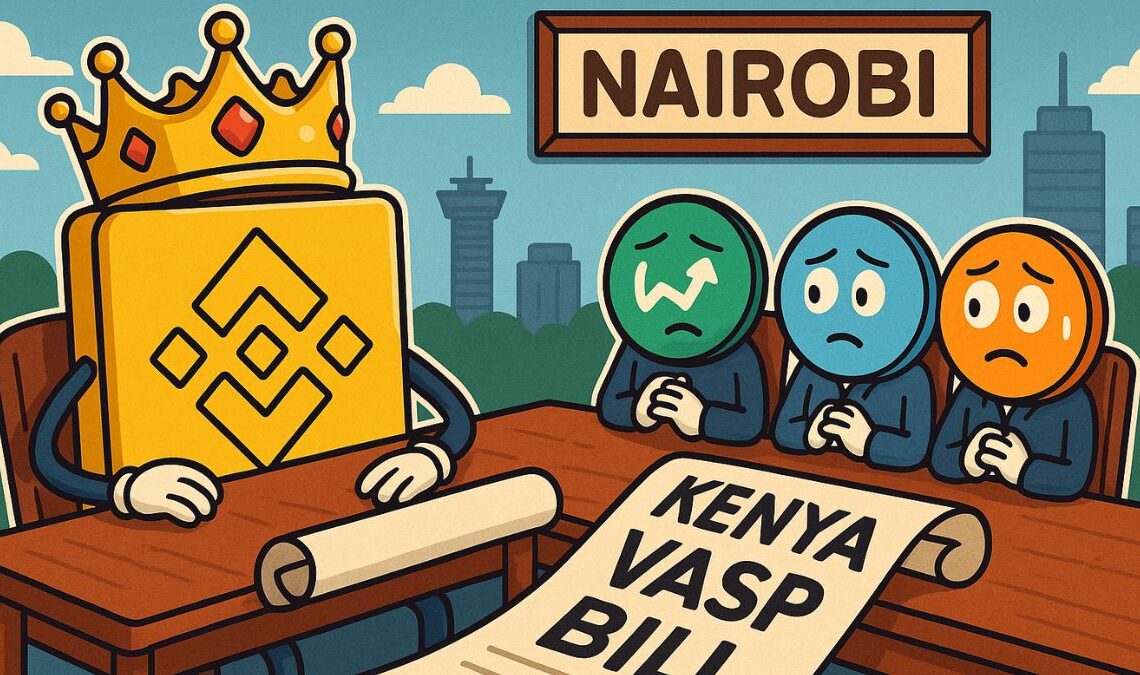

Binance’s participation in a new Kenyan crypto advisory committee has triggered backlash from local blockchain startups and industry advocates, who warn that the move could create an unfair regulatory advantage for the global exchange.

The criticism centers on the Virtual Assets Service Provider (VASP) Bill, currently under review by Kenya’s Parliament. The bill proposes a licensing framework for crypto firms and establishes the Virtual Assets Committee (VAC) as the primary advisory body to the regulator.

According to Kenyan Wall Street, Binance is one of several large firms represented in the early-stage VAC, prompting concerns over conflict of interest and potential monopolistic control.

Local Startups Say They’re Being Sidelined

Kenyan crypto entrepreneurs argue that the current composition of the VAC favors large, foreign exchanges over domestic innovators. Smaller startups claim they were not consulted during the drafting process of the VASP Bill, and that the inclusion of dominant platforms like Binance risks undermining market fairness.

Some developers warn that proposed licensing requirements could become cost-prohibitive, effectively locking out early-stage ventures and funneling volume toward established players with lobbying access.

“We are not against regulation—but regulation must be equitable,” one Nairobi-based startup founder told local press.

Government Response and Industry Implications

Kenya’s Capital Markets Authority has not commented on the composition of the VAC or confirmed Binance’s level of involvement. However, officials have expressed interest in developing a robust but flexible regulatory framework for digital assets.

If the current bill passes without amendment, it would grant the VAC influence over licensing standards, market supervision, and token approval processes. Critics say this structure could allow large stakeholders to shape rules in their favor, under the guise of regulatory alignment.

The issue has become a flashpoint in East Africa’s growing crypto economy, where trust, inclusivity, and access remain key to long-term adoption.

Final Thoughts: Binance Kenya Crypto Board Role Raises Red Flags

The Binance Kenya crypto board controversy reveals the complex power dynamics emerging in Web3 regulation. While industry involvement in policymaking can promote innovation, unchecked influence by major players risks entrenching monopolies and stifling local competition.As Kenya positions itself as a regional crypto hub, how it balances regulatory structure with market inclusivity may shape the future of African crypto adoption—and set a precedent for how global platforms participate in emerging economies.