Ark Invest has offloaded $12 million worth of Coinbase (COIN) shares in a move that caught the attention of market analysts and crypto investors alike. The trade was executed during a week of high volatility, with Coinbase stock hovering around $270 per share before closing slightly lower.

According to Yahoo Finance, Coinbase has been on a rollercoaster in recent weeks, mirroring the broader crypto market. Ark Invest, led by Cathie Wood, reportedly also trimmed its position in Block Inc. (SQ), shedding another $9.8 million in shares. This dual move is seen as part of a broader portfolio rebalancing strategy.

While no official statement has been released by Ark, The Block reports the sell-off comes just days after crypto funds reported a record $4.4 billion in inflows, raising eyebrows about Ark’s timing and strategic outlook.

Coinbase remains one of Ark Invest’s flagship holdings, particularly through its ARK Innovation ETF (ARKK). However, the recent sales may reflect short-term profit-taking or tactical reallocations as interest in tokenization, ETFs, and Layer-2 protocols intensifies across the crypto ecosystem.

Meanwhile, Block Inc.—formerly Square—has also been a longtime Ark favorite. The $9.8M offload suggests a parallel caution in fintech-linked crypto plays, especially as regulatory scrutiny and competitive pressure from platforms like Robinhood and eToro mount.

In the context of Ark’s overall exposure, these sell-offs are not necessarily signs of lost conviction. However, they do align with a period of portfolio trimming across high-volatility assets.

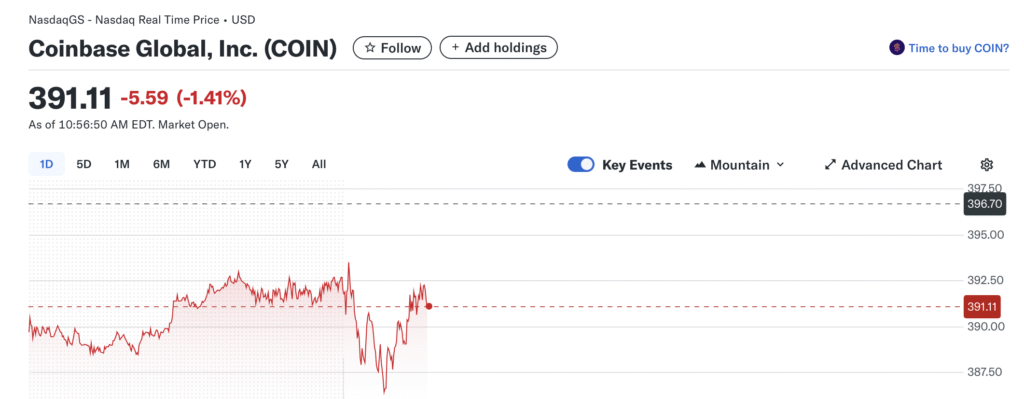

Despite the reduction, Coinbase stock continues to trade with strong volume and relative resilience, supported by the rise in U.S. crypto adoption and institutional interest in exchange-listed products like ETFs and tokenized funds.

Whether this move reflects short-term caution or a longer-term pivot remains to be seen, but the market will be watching Ark’s next moves closely—especially as macro uncertainty lingers.