Table of Contents

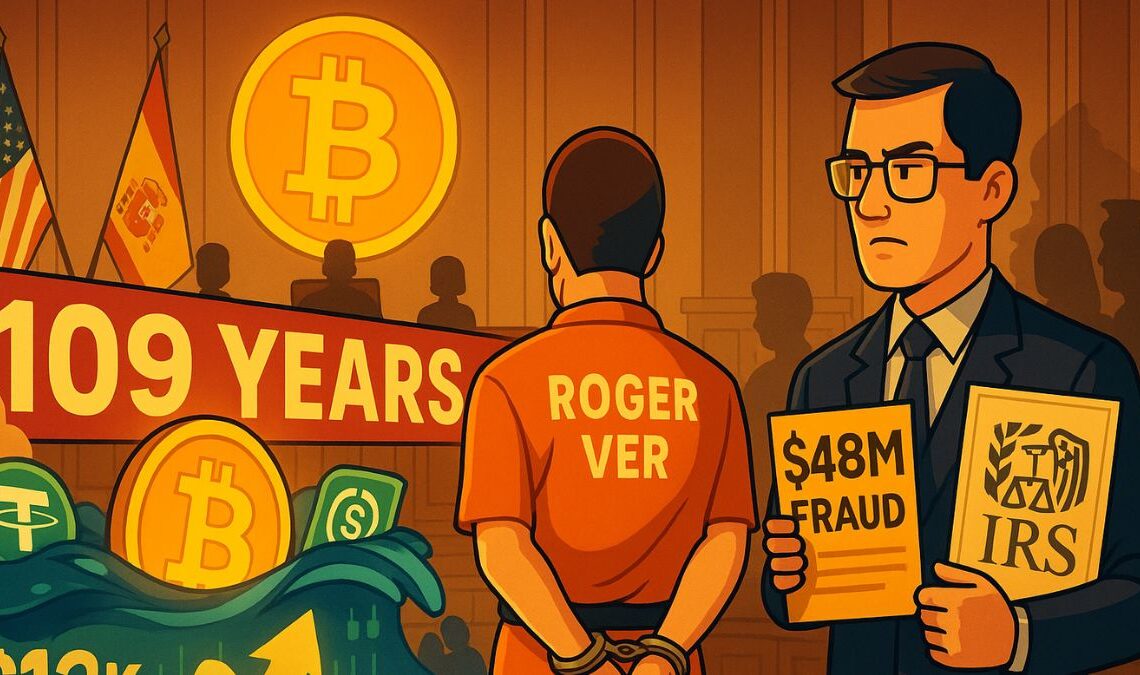

Toggle“Bitcoin Jesus” Roger Ver Faces 109-Year Prison Term Over Tax Charges

Roger Ver, once dubbed “Bitcoin Jesus” for his early evangelism of the cryptocurrency, now finds himself at the center of a dramatic legal saga. U.S. authorities have charged the crypto entrepreneur with a sweeping tax fraud case that could land him behind bars for up to 109 years, prompting Ver to take legal action to block extradition from Spain.

The case is quickly becoming one of the most high-profile legal confrontations in crypto history, raising new questions about offshore holdings, dual citizenship, and tax compliance for crypto moguls.

The Charges: $48M in Alleged Tax Fraud

According to the indictment unsealed by the U.S. Department of Justice, Ver is accused of failing to report and pay taxes on capital gains from the 2017 sale of tens of thousands of BTC, originally acquired when prices were under $1 per coin. The IRS alleges that Ver’s gains totaled nearly $240 million, from which at least $48 million in taxes went unpaid.

In addition to tax evasion, Ver is also facing charges of wire fraud and filing false tax returns, all of which could cumulatively lead to a century-long prison sentence.

Roger Ver’s Defense: Dual Citizenship and Legal Maneuvers

Currently residing in Spain, Ver is fighting extradition to the U.S., claiming that he relinquished his American citizenship in 2014 and thus should not be subject to U.S. taxation. His legal team argues that Ver had already become a citizen of St. Kitts and Nevis, and that his tax obligations ended with his renunciation of U.S. status.

However, U.S. prosecutors maintain that Ver misrepresented his holdings and income during and after the expatriation process, which kept him legally liable. The lawsuit filed in Spain seeks to block the extradition, potentially triggering a lengthy legal battle across jurisdictions.

Reactions from the Crypto Community

The news has sparked a wave of reactions online. Crypto trader @CryptoKaleo posted,

“Roger Ver once symbolized the spirit of Bitcoin decentralization — now he’s a symbol of how far we’ve come. Wild.”

Others note the irony of Ver’s libertarian ideals clashing with the tax regulations of the same system he once sought to escape. Some believe the case could set a precedent for offshore crypto taxation, especially for early adopters who cashed out large holdings without clear regulatory oversight.

Final Thoughts: What Roger Ver’s Case Means for Crypto Pioneers

Roger Ver’s legal fight isn’t just about one man — it’s a warning shot to early Bitcoin whales and crypto entrepreneurs operating in grey zones. As regulators intensify scrutiny over wealth generated during Bitcoin’s meteoric rise, cases like this are likely to multiply.Whether Ver is extradited or not, the implications are clear: crypto wealth may be decentralized, but tax enforcement is catching up fast.