The MiCA Framework is facing its first major test as the European Securities and Markets Authority (ESMA) raises concerns over how Malta is handling crypto licensing under the new EU law. This scrutiny could have major implications for how crypto firms operate in Europe’s smaller jurisdictions.

On July 8, ESMA issued a statement highlighting potential weaknesses in Malta’s crypto licensing process, urging greater harmonization and supervisory rigor across all EU member states. The regulator pointed to “significant variations” in how MiCA—the Markets in Crypto-Assets Regulation—was being applied, with Malta flagged as a country where improvements are urgently needed.

MiCA Framework at Risk of Fragmentation?

Introduced to bring EU-wide clarity to the crypto sector, the MiCA Framework aims to create a single licensing standard across all 27 member states. However, ESMA’s recent warning suggests that local implementation may already be diverging, threatening the framework’s core purpose.

According to ESMA’s official release, “there are emerging inconsistencies in how authorizations are being granted under MiCA, particularly in jurisdictions where crypto businesses already had regulatory footholds.”

Malta, known for being an early crypto adopter with a relatively open regulatory environment, is now under the spotlight. The concern is that the country’s existing licensing structure might be too lenient to align with MiCA’s intent of robust consumer and market protection.

Malta’s Response and Licensing Landscape

The Malta Financial Services Authority (MFSA) maintains that it has been working to update its systems in compliance with MiCA. In a statement posted on its Financial Services Register, the regulator noted that it is “engaging closely with ESMA to ensure full conformity with EU standards.”

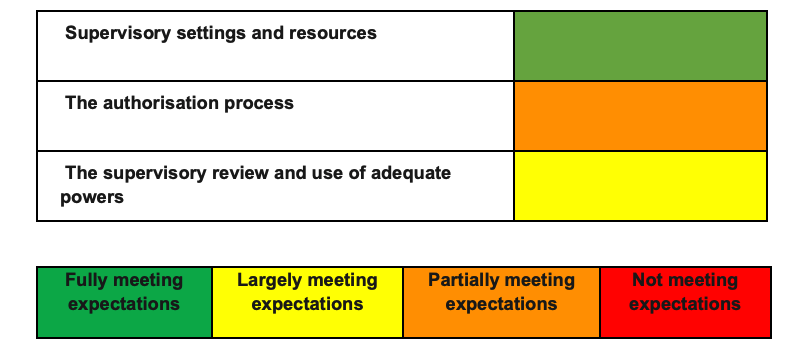

A visual summary of the PRC’s assessment of the MFSA by assessment area. Source: ESMA

Yet industry insiders suggest the MFSA’s transitional approach might allow some firms to “grandfather in” earlier licenses under softer rules, giving them an unfair competitive edge in the pan-European market.

This has raised red flags among other EU members concerned about regulatory arbitrage, where companies may choose to base operations in more lenient jurisdictions.

Industry Impact: Firms Rethinking Licensing Strategy

Crypto exchanges, wallet providers, and token issuers who hoped to use Malta as a regulatory gateway into the EU are now reconsidering. While Malta previously attracted firms due to its crypto-friendly stance, the ESMA announcement may shift interest toward countries with stricter compliance regimes to avoid future uncertainty.

Legal experts warn that any regulatory misalignment under the MiCA Framework could lead to revocations of licenses or additional scrutiny from EU bodies.

A Sign of MiCA Growing Pains?

This development also signals the challenges ahead for MiCA enforcement. While the framework officially took effect in 2024, its success relies heavily on consistent implementation. Discrepancies between nations, as seen in Malta’s case, could undermine its goal of a uniform crypto regulatory environment.

Some stakeholders argue that this is an expected part of onboarding such a sweeping regulation. Others, however, warn that failure to act decisively now may erode trust in MiCA altogether.

What’s Next for the Mica Framework and Malta?

The EU is likely to push for standardized audits and approval procedures across all national regulators, including Malta, to ensure that MiCA is being respected both in letter and spirit.

Whether Malta tightens its controls or continues on its current path will be a litmus test for how serious EU institutions are about upholding MiCA.

Final Thoughts: What the Malta Case Means for the MiCA Framework

As Malta faces pressure from the EU, the crypto industry is watching closely to see how this will reshape the broader implementation of the MiCA Framework. This incident underscores the need for uniform standards across the bloc and highlights the importance of regulatory transparency at a time when the crypto sector seeks legitimacy on the global stage.If the EU wants MiCA to work, then member states like Malta will need to align quickly—or risk becoming a weak link in Europe’s crypto ecosystem.