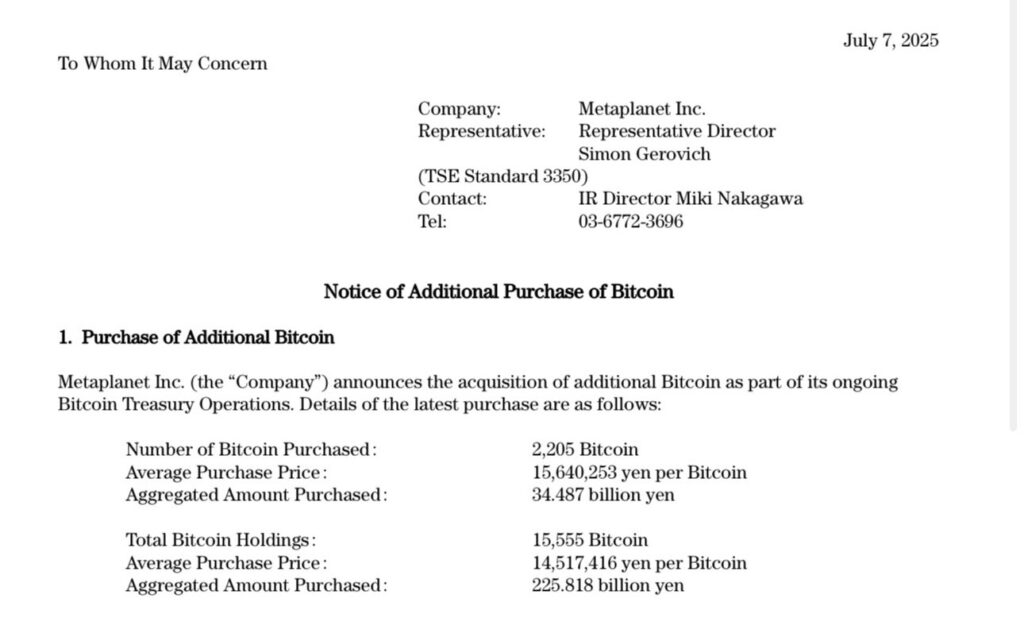

Japan’s Bitcoin giant MetaPlanet has once again deepened its commitment to digital assets. The Tokyo-listed firm announced the acquisition of 2,205 additional BTC, bringing its total Bitcoin holdings to an impressive 15,555 BTC. The news reinforces MetaPlanet’s position as one of the most aggressive institutional Bitcoin buyers in Asia.

The disclosure, made public on July 7 via the official X account, showed that the company purchased the latest batch at an average price of $62,412 per BTC. This move follows several previous acquisitions, aligning with the firm’s strategy of converting treasury reserves into Bitcoin as a hedge against fiat devaluation.

Strategic Accumulation Continues Despite Market Volatility

According to the official filing, MetaPlanet spent nearly ¥22.5 billion yen (approx. $138 million) on this latest transaction. The average purchase cost is still significantly below current spot prices near $109,000, highlighting the long-term conviction behind the move.

*Metaplanet Acquires Additional 2,205 $BTC, Total Holdings Reach 15,555 BTC* pic.twitter.com/VqKGOwCs6N

— Metaplanet Inc. (@Metaplanet_JP) July 7, 2025

Source: Metaplanet Disclosure

Unlike many corporate holders that remain passive, MetaPlanet has followed a dollar-cost averaging approach. The firm previously disclosed that its BTC purchases are part of a broader strategy to align its treasury management with digital assets, a narrative reminiscent of MicroStrategy’s multi-year strategy in the West.

This latest acquisition marks the fourth major BTC purchase by MetaPlanet in 2025 alone, demonstrating resilience amid both regulatory uncertainty and rising volatility in the crypto market.

Institutional Demand in Asia Keeps Surging

MetaPlanet’s activity echoes a broader trend among institutional players in Asia. As Japanese interest rates remain near zero and inflationary pressures rise globally, companies are seeking alternative stores of value.

The disclosure also detailed MetaPlanet’s cumulative BTC holdings over time, showing steady growth since Q1 2024. Market observers now place the company among the top 5 public firms holding Bitcoin, alongside the likes of MicroStrategy and Tesla.

Analysts view MetaPlanet’s aggressive stance as a potential trigger for other regional corporations to follow suit, especially given Bitcoin’s favorable treatment under Japanese tax rules.

Final Thoughts: Why MetaPlanet’s Bitcoin Strategy Matters

With 15,555 BTC under its control, MetaPlanet isn’t just a passive investor—it’s signaling a deep, macro-level shift in treasury management for public companies in Japan. Its consistent Bitcoin accumulation strategy could reshape how institutional investors in Asia approach digital assets.

As Bitcoin stabilizes above $109,000 and institutional interest grows globally, MetaPlanet’s long-term positioning might pay off handsomely. For now, all eyes are on Tokyo as the company quietly becomes a key pillar of Bitcoin’s global supply dynamics.